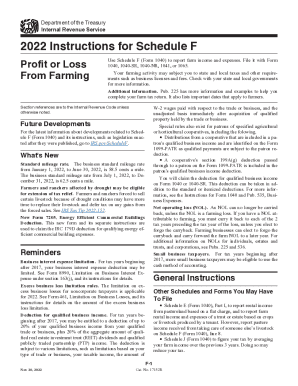

2024 Schedule F Instructions 1040 – Stay informed about U.S. taxation for the year 2023. Learn about Form 1040, Schedules, filing deadlines, and essential instructions. Ensure a smooth tax season. . If you missed it when you filed, file an amended return on Form 1040-X to recapture your overpaid self-employment tax. Schedule F, LLCs, Partnerships and S Corporations The Internal Revenue .

2024 Schedule F Instructions 1040

Source : www.uslegalforms.com1040 (2023) | Internal Revenue Service

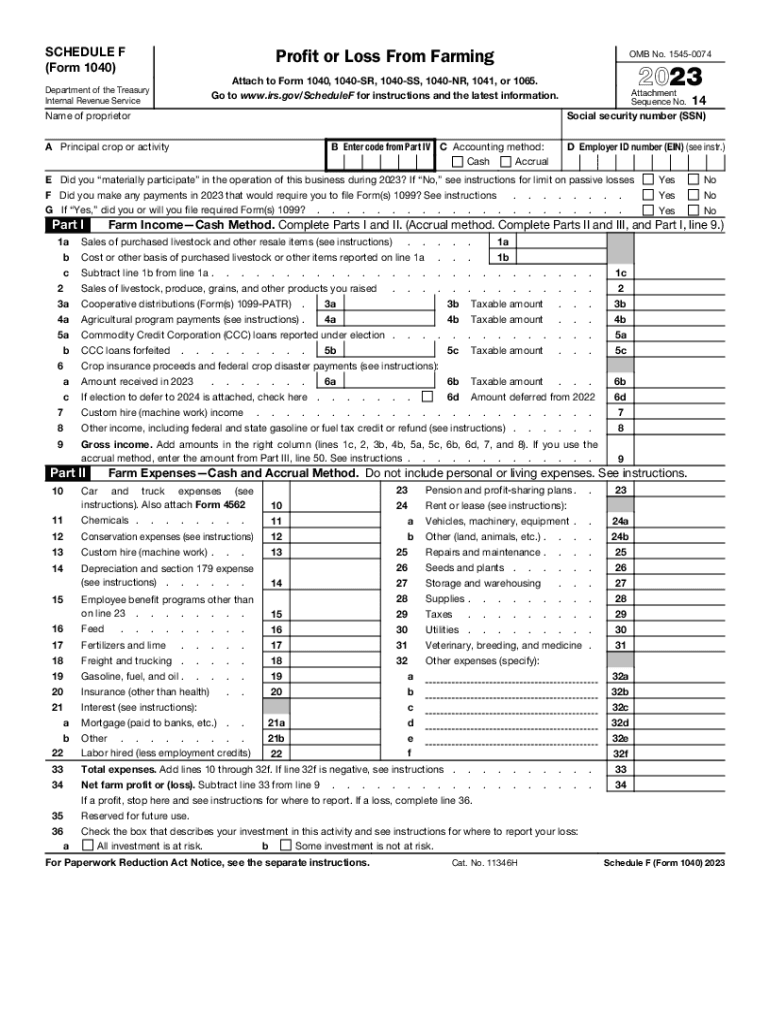

Source : www.irs.gov2023 Form IRS 1040 Schedule F Fill Online, Printable, Fillable

Source : schedule-f-form.pdffiller.com1040 (2023) | Internal Revenue Service

Source : www.irs.govSchedule f: Fill out & sign online | DocHub

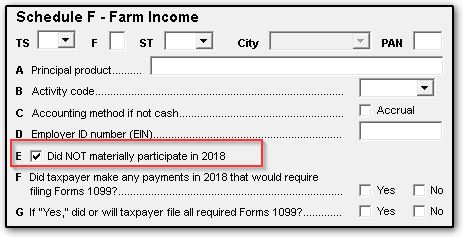

Source : www.dochub.comSchedule F Frequently Asked Questions (4562, ScheduleF)

Source : drakesoftware.comIRS 1040 Schedule F Instructions 2022 2024 Fill and Sign

Source : www.uslegalforms.com2023 Schedule F (Form 1040)

Source : www.irs.govSchedule f instructions: Fill out & sign online | DocHub

Source : www.dochub.comAll About Schedule A (Form 1040 or 1040 SR): Itemized Deductions

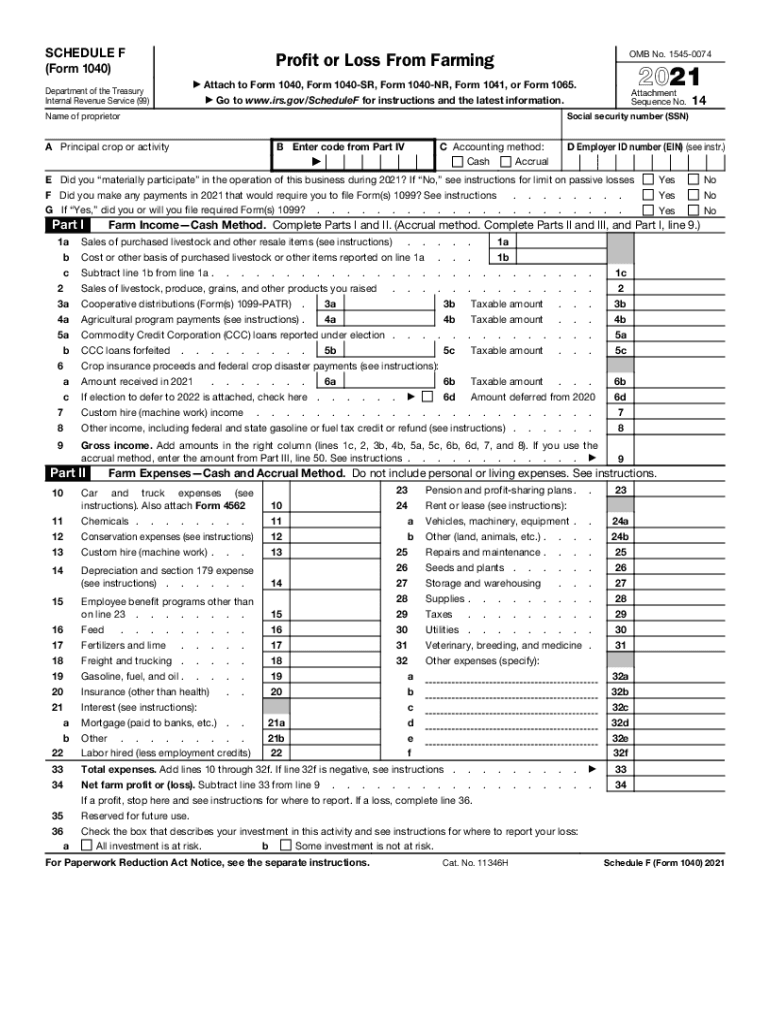

Source : www.investopedia.com2024 Schedule F Instructions 1040 IRS 1040 Schedule F Instructions 2021 2024 Fill and Sign : If you run it as a sole proprietorship or single-member limited liability company (LLC), you’ll typically report all of your income and expenses on Schedule C or Schedule F if it’s for farming. . The Internal Revenue Service (IRS) has recently released the updated Schedule 1 tax form and instructions for the are not listed on the standard Form 1040. It includes sections for reporting .

]]>

:max_bytes(150000):strip_icc()/ScheduleA2023-641f841b859949f28b094e61efecc58b.png)